Prevailing Wage Log To Payroll Xls Workbook : Prevailing Wage Log To Payroll Xls Workbook - Record below .... Pacific time on friday, may 21, 2021 to 1:00 a.m. Accrued wages 8,100.00 accrued payroll taxes 1,006.07 total 9,106.07 9,106.07 general journal entries for reversal of payroll accrual reverse accrual date: Prevailing wage log to payroll xls workbook / payrolls office com : Certified payroll reports must include a listing of the workers on the project, including work classifications, hours worked, wage rates, benefits, overtime compensation, total wages paid, and information related to payroll deductions. Department of labor, indicate that working foreman or supervisors that regularly spend more than.

ads/bitcoin1.txt

/ federal prevailing wage requirements, through the u. Prevailing wage log to payroll xls workbook / payrolls office com : • the trns•port excel payroll spreadsheet was designed with smaller contractors or small contractor crew sizes in mind. What is onduty as per employee compensation act. Ohio's prevailing wage laws apply to all public improvements financed in whole or in part by public funds when the total overall project cost is fairly estimated to be more than $250,000 for new construction or $75,000 for reconstruction, enlargement, alteration, repair, remodeling, renovation, or painting.

Accessing the certified transcript of payroll portal.

ads/bitcoin2.txt

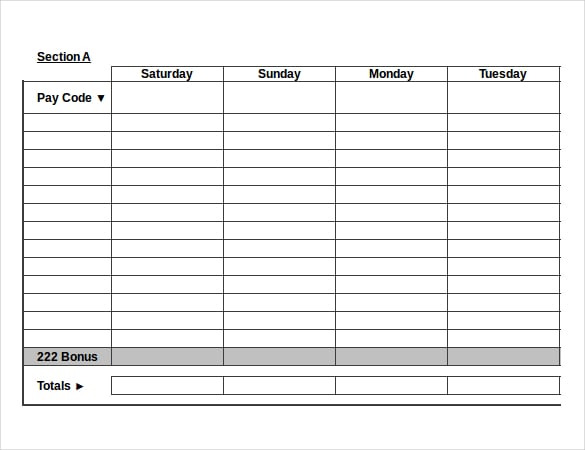

Department of labor, indicate that working foreman or supervisors that regularly spend more than. Prevailing wage log to payroll xls workbook : Skip to main content make … prevailing wage rates are the amounts that must be paid to construction workers on all public works projects in. Certified payroll reports must include a listing of the workers on the project, including work classifications, hours worked, wage rates, benefits, overtime compensation, total wages paid, and information related to payroll deductions. Accessing the certified transcript of payroll portal. Use this employee payroll template to record your employee payroll and calculate hourly paychecks. The requirement to pay prevailing wages as a minimum is true of most employment based visa programs involving the department of labor. Use payroll stub templates to conveniently generate detailed pay stubs for each of your employees. Public works prevailing wage rates. Maximum salary wage limit for calculation of employee compensation? Pacific time on saturday, may 22, 2021. Example of creating a payroll in excel; One which calculates payroll based upon regular and overtime hours worked, as well as sick leave and vacation;

Yes, all prevailing wage work must be done by contract. Department of labor, based upon a geographic location for a specific class of labor and. While most organisations turn their heads towards software like tally or adp for payroll, or they give a contract to some outsourcing companies to provide them with the payroll services without any fuss. Pr payroll register reno graphics payroll register november deductions federal social cum. Certified payroll reports must include a listing of the workers on the project, including work classifications, hours worked, wage rates, benefits, overtime compensation, total wages paid, and information related to payroll deductions.

One for employee wage and tax information;

ads/bitcoin2.txt

Vendors/contractors can either use the payroll spreadsheet conversion process or manually enter data if they do not have a computerized payroll system capable of generating a payroll xml file to import into aashto project. 2021 prevailing wage & fringe benefit rates Contracting vendors, who may not have internet access, can use any public computer (e.g. Payroll in excel (table of contents) introduction to payroll in excel; The requirement to pay prevailing wages as a minimum is true of most employment based visa programs involving the. Documents similar to raci for payroll.xls. Enter a date range, then select get quickbooks data. Department of labor, based upon a geographic location for a specific class of labor and. The requirement to pay prevailing wages as a minimum is true of most employment based visa programs involving the department of labor. Excel payroll templates help you to quickly calculate your employees' income, withholdings, and payroll taxes. One for employee wage and tax information; • the trns•port excel payroll spreadsheet was designed with smaller contractors or small contractor crew sizes in mind. Prevailing wage log to payroll xls workbook / prevailing wage determination pdf free download.professional regulation unit/prevailing wage section 1511 pontiac avenue building 70, p.o.

While most organisations turn their heads towards software like tally or adp for payroll, or they give a contract to some outsourcing companies to provide them with the payroll services without any fuss. The prevailing wage for each classification includes an hourly base rate and an hourly fringe rate, and it is the combination of these two amounts that must be paid to the worker. 2021 prevailing wage & fringe benefit rates Pacific time on saturday, may 22, 2021. Documents similar to raci for payroll.xls.

But if you're in a state that has its own prevailing wage law, your certified payroll reports can be much more complicated.

ads/bitcoin2.txt

Prevailing wage log to payroll xls workbook. Payroll in excel (table of contents) introduction to payroll in excel; Minnesota department of small works public works contract ($2,500 or less including tax. The bureau of public work administers articles 8 and 9 of the new york state labor laws: A local library computer) or another Instructions for filing certified payroll reports Use payroll stub templates to conveniently generate detailed pay stubs for each of your employees. Enter a date range, then select get quickbooks data. Using an excel sheet to manage payroll is a diy approach that is more suitable for small teams. Maximum salary wage limit for calculation of employee compensation? Pacific time on saturday, may 22, 2021. Prevailing wage log to payroll xls workbook / prevailing wage determination pdf free download.professional regulation unit/prevailing wage section 1511 pontiac avenue building 70, p.o. Accrued wages 8,100.00 accrued payroll taxes 1,006.07 total 9,106.07 9,106.07 general journal entries for reversal of payroll accrual reverse accrual date:

ads/bitcoin3.txt

ads/bitcoin4.txt

ads/bitcoin5.txt

0 Response to "Prevailing Wage Log To Payroll Xls Workbook : Prevailing Wage Log To Payroll Xls Workbook - Record below ..."

Post a Comment